When the Normal Town Council held a public hearing Dec. 4 to consider raising city property taxes by 6 percent, only about 10 people showed up to oppose the action, according to meeting coverage on WGLT 89.1 FM’s website.

That modest turnout likely belies citizens’ true opposition to raising the city's property tax levy to $12.9 million, a move town leaders say is necessary to fund pensions for police officers and firefighters. WGLT’s report said the city is required to fund 90 percent of the pensions by 2040, a General Assembly mandate.

Insolvent pension liabilities seem to be among the most serious issues nagging Illinois, as both city and state governments struggle with funding. In June, Forbes magazine listed Illinois as having one of the country’s worst pension-funding crises.

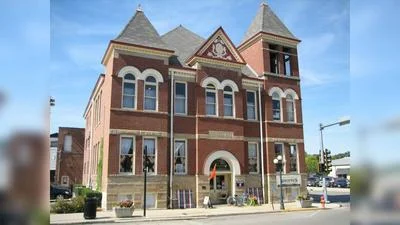

Normal, Ill. Mayor Chris Koos

“The bad news is that in the states with some of the worst unfunded pension liabilities – such as California, Illinois and New York – the political class is currently neglecting this growing crisis, and there appears to be no will among the powers that be in Sacramento, Springfield and Albany to implement the reforms necessary to rectify the matter,” Forbes contributor Patrick Gleason wrote.

Raising taxes or deficit spending have been the fallback solutions. In May, WGN-TV reported the General Assembly had raised the Illinois individual income tax to 32 percent. In November, Chicago, in debt $36 billion for pensions, passed a $3.77 billion budget that will rely on $574.5 million in bond issues to cover shortfalls, according to coverage by Reuters.

Although a hypothetical example given by WGLT claims the increase in Normal would only add $40 a year to the bill owed on a $165,000 house, residents are still expected to feel the pinch.

In the WGLT piece, Normal resident Jarrod Rackauskas was quoted as saying the state’s already high taxes have forced him to cut back on discretionary spending. Illinois’ tax burden is No. 1 in the nation, according to a study referenced by the Chicago Tribune

“As a median citizen with increasing tax costs, I have been forced to say 'no' to the Mediterranean platter at the Coffeehouse, 'no' to the occasional round of golf at Ironwood, 'no' to coffee at Gloria Jean's with my wife, 'no' to a family pool pass at Fairview in the summer,” Rackauskas told WGLT.

Residents who spoke at the meeting questioned the council’s decision-making process that led to the need for a tax increase. Their comments were captured via video and posted on YouTube.

“The reason you need this tax increase is because you’ve indebted the town of Normal so badly you can’t even pay the interest,” Angela Scott, the first speaker, said. “If you’re going to raise taxes, at least be honest about it.”

“' really don’t want to raise taxes’ – I don’t know how many times I’ve heard this council and other councils before say that,” Doug Fansler said. “I’m pretty sure we wouldn’t need a tax increase tonight if I had a dollar or two for every time I heard that.”

The light turnout of protesters at the Dec. 4 meeting may have less to do with voter apathy and more to do with lack of awareness, Normal Mayor Chris Koos told WGLT. Koos said the city plans on deploying a new website to keep better in touch with its residents.

“I think the first thing you’re going to see is on a website (we're making) called Myth and Fact,” Koos told WGLT. “We’re going to take some of these issues that are going around that are commonly held beliefs and put the flesh in the background of it so people really know what’s going on.”

Alerts Sign-up

Alerts Sign-up