Shortly after a property tax freeze amendment failed in the Illinois General Assembly during the fall veto session, Bloomington City Township Supervisor Deborah Skillrud, one of the highest paid officials in that township, offered her view on how property taxes work in the state.

"The state of Illinois is divided into four sections, northern, Cook and the collar counties, central and southern," Skillrud told the McLean County Times. "The needs and services provided are impacted by the geographical area of the state."

Skillrud said she could not speak for all townships in Illinois but only as supervisor of Bloomington City Township, which she described as "an urban, coterminous township." Bloomington City Township has a population approaching 77,000, according to the 2010 census, making the township one of the largest in the state outside the Chicago area.

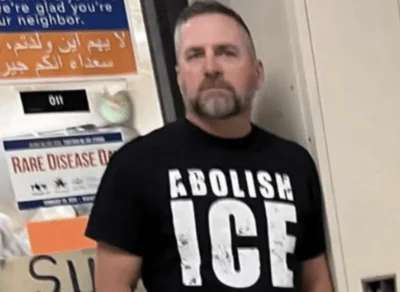

Bloomington City Township Supervisor Deborah L. Skillrud

| Photo courtesy of Deborah L. Skillrud

"Townships, like the public schools, rely on property taxes, as approximately 90 percent of all revenue comes from property taxes," Skillrud said.

"Townships provide unique and vital services. The (Bloomington) City Township provides property assessments (and) general assistance, and Evergreen Memorial Cemetery is a component unit of the township. Townships may also provide road maintenance, social services, (i.e. youth, senior, health, mental health, transportation). Townships contribute to the quality of life of the community," Skillrud said.

Skillrud ranks as the second highest paid Bloomington City Township employee, the McLean County Times reported earlier this year, citing Illinois Municipal Retirement Fund records from 2015. Skillrud receives a salary of $91,333 behind top ranking Township Assessor Steven Scudder, who receives $94,999, according to those records.

Her comments to the McLean County Times about property taxes came a few weeks after a memorandum issued by Township Officials of Illinois Executive Director Bryan Smith asked township officials to urge state lawmakers to oppose the amendment for property tax freeze bill.

Amendment 1 of Senate Bill 851 would have implemented a two-year property tax freeze for Cook and some collar counties while counties in the rest of the rest of Illinois would have been left to freeze property taxes via voter referendum. "This would mean for those townships/road districts in those counties, this year and next year your extension limitation would be zero percent unless voters approve an increase," Smith said in the legislative alert. "In all other counties outside of Cook and the collar counties, the amendment, if passed, would allow a county board to place a referendum on the ballot in 2018 to have a property tax freeze for all local governments within that county for 2018 and 2019; or whether to have all local governments within the county subject to a property tax freeze for 2018 and 2019 and then subject to the Property Tax Extension Limitation Law (PTELL) for levy year 2020 and thereafter."

SB 851 passed out of the House but was not brought up for a vote in the Senate before the veto session ended.

Skillrud said Bloomington City Township does not duplicate its services but, instead, uses part-time employees to control wages, benefits and other costs.

"Townships services are provided at low cost in an efficient, effective manner that is responsive to the citizens," Skillrud said. "Small local governments work with the local citizens to provide services. There is better money management."

Skillrud said that there also is "no one size fits all" to property taxes, placing that burden on lawmakers in Springfield.

Meanwhile, Bloomington City Township cooperates with other local governmental units to control or even reduce costs through intergovernmental agreements, Skillrud said. "Townships believe in local democracy," she said

"There should be citizen participation. Townships are interested in the good of the people and well being of the community. Citizens should have an understanding of where their property tax dollars go, i.e. to which local governmental unit, providing what services, and at what costs.

Local governmental units in central Illinois "tend to levy what is needed," Skillrud said. "The (Bloomington) City Township has held the tax levy flat for the last three years. This year a slight increase is needed to cover cost increases, (i.e. utilities, fuel, insurance, etc.). Due to the fact the City Township government is a small percentage of the property tax bill, the impact should be small."

Alerts Sign-up

Alerts Sign-up